×

×

☰

☰

Insurance is a vital safety net, providing individuals financial protection against unforeseen events. Insurance claim processing is the process that starts once a policyholder files a claim. It involves validating the claim, assessing the damage or loss, and determining the compensation amount. However, insurance companies often encounter challenges as policyholders and claims grow. Inaccuracies, inconsistencies, and slow processing times can lead to dissatisfied customers and increased operational costs. In such cases, ensuring the claim processing system is robust, efficient, and error-free becomes necessary.

Data-Driven Testing (DDT) involves executing the same test scripts with varying data sets multiple times. Instead of manually inputting test scenarios or having limited test cases, DDT leverages extensive datasets to ensure a system’s functionality across numerous scenarios. For industries like insurance, where every claim has unique characteristics, DDT offers a comprehensive way to verify systems and reduce errors.

Data-driven testing is a methodology wherein test scripts are designed to be executed repeatedly using different yet structured input values sourced from data files such as spreadsheets, CSV files, or databases. It also validates multiple test cases by changing the input data rather than the test scripts. This approach not only streamlines the testing process but also enables enhanced test coverage, ensuring that the system under test can handle a variety of scenarios.

Traditional testing methods often involve manually inputting predefined test cases or preparing individual test scripts for different scenarios. This approach, though systematic, can be time-consuming and might not cover all potential real-world use cases, especially when there’s a vast array of scenarios to consider.

In contrast, data-driven Testing offers the following:

• Unlike traditional methods where data is embedded within the test scripts, DDT keeps the test data separate. It enables easy updates to the data without tampering with the test logic.

• Testers can ensure they’ve accounted for many scenarios by feeding diverse data sets into the test scripts.

• Instead of writing or modifying test scripts for each new scenario, testers can swiftly adapt by changing the input data. It accelerates the testing process considerably.

Insurance claim processing is a domain where even minor errors can result in significant financial implications and potential customer dissatisfaction. As the demand for swift and accurate claim processing rises, data-driven testing is a robust solution. Here’s how DDT can play a pivotal role in enhancing insurance claim processing:

Every insurance claim, irrespective of its nature, demands precise processing. With DDT, insurance companies can execute the same test scripts across multiple data sets, ensuring that their claim processing system operates correctly across various claim scenarios. This repetitive testing approach eradicates inconsistencies and reduces the involvement of human-generated errors, leading to improved accuracy in claim assessments and payouts.

Time is of the essence in the insurance industry. Policyholders expect their claims to be processed swiftly. With their manual data inputs and individualized test cases, traditional testing methods can take time and effort. DDT, on the other hand, streamlines the process. By automating the testing with diverse data sets, DDT drastically reduces the overall testing time, enabling quicker system validations and, by extension, faster claim processing.

The insurance industry continually evolves, with new types of claims, policy modifications, and varying customer expectations. With traditional testing, accommodating these changes can take time and effort. DDT offers inherent scalability. As the volume or variety of claims grows, DDT can quickly adapt, ensuring the testing framework remains relevant and comprehensive without significant overhauls.

Insurance claims are diverse. The scenarios are vast and varied, from accident claims and medical emergencies to property damage and thefts. DDT ensures all possible claim scenarios, even the edge cases, are thoroughly tested and validated. By leveraging extensive data sets, DDT guarantees that the claim processing system is equipped to handle any claim that comes its way, ensuring no scenario goes untested.

Data-driven testing practical applications in the insurance sector, particularly in claim processing, are profound. Let us look into the real-world applications of DDT in the domain:

Every insurance claim is a unique narrative, a distinct scenario. Whether it’s a minor car bump, a significant health emergency, or a house affected by a natural disaster, each claim tells a different story. DDT enables insurance providers to simulate these multifaceted real-world scenarios by feeding diverse data sets into their systems. It ensures that the claim processing software can handle various situations, from the most common to the most unusual, without a hitch.

Insurance claims operate within a structured framework of business rules. These could range from coverage limits, deductibles, or even specific conditions that must be met for a claim to be valid. With its structured data-driven approach, DDT ensures these rules are applied consistently and correctly across different claim types and scenarios. For instance, if a particular insurance policy doesn’t cover flood damages, DDT can be employed to test multiple claims against this rule to ensure the system denies claims arising out of flood damages appropriately.

Insurance claim processing isn’t an isolated function. It must integrate seamlessly with other systems – customer databases, payment gateways, third-party service providers, and more. DDT plays a crucial role in validating these integrations. By using diverse data sets, insurers can ensure that data flows smoothly across integrated systems, maintaining data integrity and seamless operations.

As insurance companies update or upgrade their claim processing software, there’s a risk that existing functionalities might break. Data-driven testing is crucial here. By running previously used data sets against updated systems, insurers can ensure that new changes haven’t inadvertently affected existing functionalities.

There are instances like natural disasters when insurance companies receive a surge in claim requests. It’s necessary that their systems can handle this increased load without faltering. Data-driven testing, using large data sets, can simulate these high-load scenarios, ensuring that the claim processing system performs optimally even under stress.

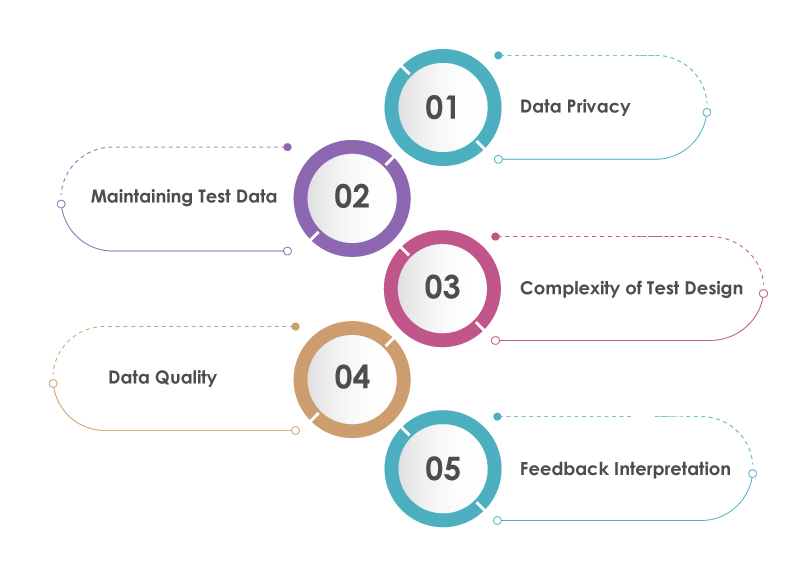

While Data-Driven Testing offers various benefits to insurance claim processing, it also has some challenges. Integrating DDT requires thoughtful consideration of several factors. Let’s look into some of the primary challenges and considerations associated with DDT in the insurance realm:

Handling sensitive claim data is a significant responsibility. When using actual claim data for testing, there’s a risk of exposing private information. Employing robust encryption techniques is essential to ensure no sensitive data gets compromised. Additionally, complying with data protection regulations, such as the GDPR or CCPA, is necessary, making this challenge even more critical.

Over time, business rules, claim scenarios, and policy structures can evolve. It necessitates updating the test data sets to reflect these changes accurately. Maintaining a comprehensive, relevant, and updated test data library can be demanding, especially when dealing with vast amounts of data spanning diverse scenarios.

While DDT allows for comprehensive testing, designing these tests can be complex. Creating generic tests to handle diverse data sets yet specific enough to yield meaningful results requires a balance of expertise and foresight.

For DDT to be effective, the quality of the input data is crucial. Poor or inaccurate data can lead to misleading test results. Insurance companies must ensure the testing data is high quality, accurate, and relevant.

With traditional testing, feedback on errors or issues is usually specific to the test case. However, with DDT, given the volume of data and scenarios tested, pinpointing the exact cause of an error might be more challenging, requiring more profound analysis and potentially more time.

By offering enhanced accuracy, efficiency, and comprehensive coverage, data-driven testing can significantly improve the claim processing experience for both the insurer and the insured. However, as with any transformative approach, it comes with challenges. From maintaining data privacy to ensuring test data quality, DDT integration demands careful consideration and planning. Yet, the benefits that come in the form of streamlined operations, reduced errors, and heightened customer trust make it the right choice for insurance businesses.

Source: TestingXperts